It has been my great privilege and honor to serve in the Federal Reserve System.

over the course of three eventful decades–as a member of the board of Governors as President of the Federal Reserve Bank of San Francisco, and, most especially, as Vice Chair and Chair of the board.

I am enormously proud to have worked alongside many dedicated and highly able women and men, particularly my predecessor as Chair, Ben S Bernanke, whose leadership during the financial crisis and its aftermath was critical to restoring the soundness of our financial system and prosperity of our economy.

As I prepare to leave the Board, I am gratified that the financial system is much

stronger than a decade ago, better able to withstand future bouts of instability and continue supporting the economic aspirations of American families and businesses. I am also gratified by the substantial improvement in the economy since the crisis. The economy has produced 17 million jobs, on net, over the past eight years and, by most metrics, is close to achieving the Federal Reserves statutory objectives of maximum employment and price

stability. Of course, sustaining this progress will require continued monitoring of, and decisive responses to, newly emerging threats to financial and economic stability.

The Federal Reserve has been and remains a strong institution, focused on carrying out its vital public mission with integrity, in a professional, non-partisan manner.I am confident that my successor as Chair, Jerome H. Powell, is deeply committed to that mission and I will do my utmost to ensure a smooth transition.

Related news:Yellen Resigns From Fed Board After Being Passed Over To Keep Top Post

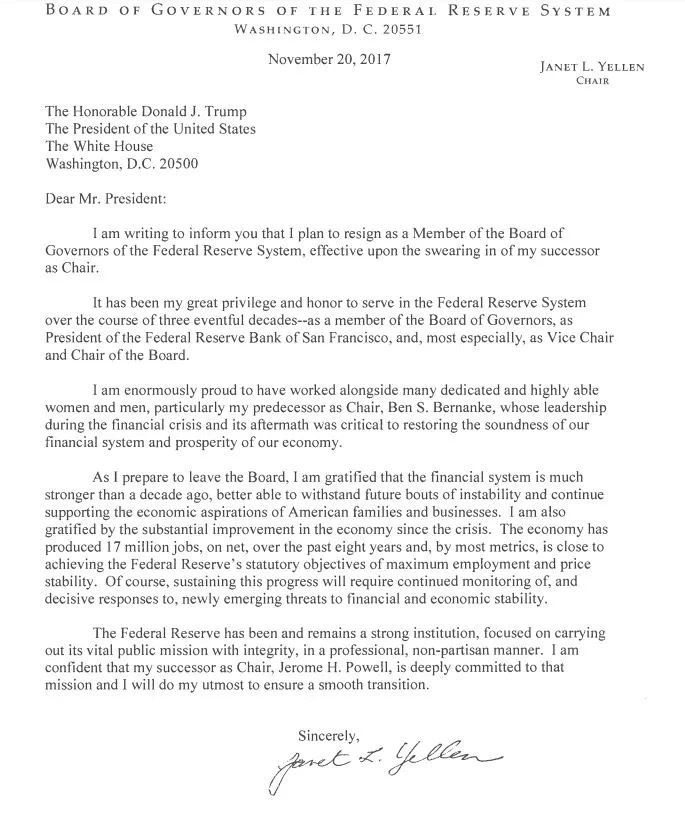

Federal Reserve Chair Janet Yellen today announced that she will resign from the Federal Reserve Board once her successor, Jerome Powell, is sworn in.

Yellen is the first woman to serve as Fed chair. While her term as Fed chair ends in February, Yellen could have stayed on the board until 2024, serving out her 14-year term as a Fed governor. Instead she’ll follow the practice of previous Fed leaders and leave the board once Powell becomes chairman.

Powell’s nomination by President Trump marked the first time in decades that a president hasn’t reappointed a chief of the central bank for a second term. The Senate Banking Committee is set to hold a hearing on Powell’s nomination next week, but a vote has not been scheduled.

In a letter of resignation to Trump, Yellen said she is “gratified that the financial system is much stronger than a decade ago,” and that the economy has improved substantially. Also in the letter, she pointed out that 17 million jobs have been added since the financial crisis and that the Fed is close to achieving it goals of “maximum employment and price stability.”